Stay In The Know

Signup to be notified of news announcements and promotions.

Square reported earnings and one thing from the report really caught my eye. They reported that a higher percentage of revenue is coming from large merchants. Square offers a simple pricing structure of 2.75% per transaction (or 3.5% and $0.30 if Keyed In). This is a great deal for some merchants but a bad deal for others. At Bevel we actually refer people to Square if they process small transactions. When your average transaction is $5-$8 it makes sense to pay a flat 2.75% and we are happy to point you in that direction.

The part of their report that surprised me was that they reported growth with large merchants. They consider large merchants anyone who processes between $125,000 and $500,000+ annually. Square is a great option for small merchants, but they are usually not the best option for large ones. 2.75% flat with no other fees works great for small transactions, but not if you process large ones. If you are a large merchant, paying 2.75% is one of the most expensive ways to process credit cards.

Large Businesses are Not a Good Fit

Interchange rates are set and published by the card brands and they are the same for everyone. If you look at the long list of rates published by Visa and Mastercard, they range from .05% and $0.22 for a debit card, up to about 2.95% and $0.10 for some commercial cards. So with Square you are guaranteeing that you will pay close to the highest possible rates available.

All of the credit cards in your wallet have an interchange rate attached to them. Square is paying that rate, but they are charging you 2.75% whether the actual interchange rate is higher or lower. When I look in my own wallet I see 2 cards. My Bank of America debit card has a rate of .05% and $0.22 and my Amazon Rewards card is 1.65% and $0.10. If I purchase something with my Amazon card and the merchant is using Square, the merchant pays 2.75% and Square keeps the difference (just over 1%). Reading through Square’s earnings report, they said that their average profit per transaction was 1.01%, so the example above sounds about average.

This Member Switched to Bevel and saved $4,000/yr

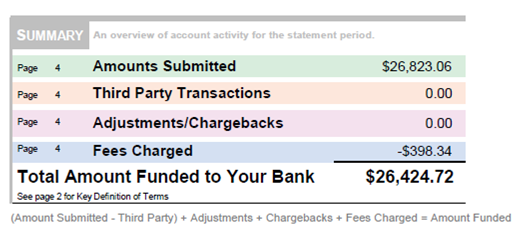

Below is a snapshot from an actual merchant who was using Square before switching to Bevel. He processed $26,823 and paid a total of $398.34 in fees (1.48%) with Bevel. This same bill would have been $737.63 (2.75%). This is the type of merchant that Square is referring to in their earnings report. He will save over $4,000 this year by switching to Bevel to process credit cards.

Square is great for certain businesses and we refer people to them on a daily basis, but if you are a large merchant, Bevel with our true interchange rates will save you money. Give us a call and speak to one of our experts. We can analyze your business needs and if we are not the right fit, we would be happy to suggest an alternative.

One of our sales agents will call you soon to discuss what payment solutions will work for your business.

Signup to be notified of news announcements and promotions.